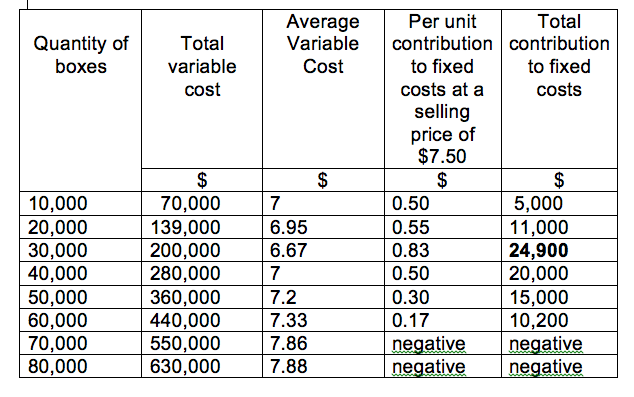

It can choose between paying $1,000 (fixed cost) or $0.05 for every item manufactured. Imagine a company wants to rent a piece of equipment. Variable costs impact a company's expense structure.By performing variable cost analysis, a company can easily identify how scaling or decreasing output can impact profit calculations. Gross margin, profit margin, and net income calculations are often calculated with a combination of fixed and variable costs. Variable costs determine margins and net income.A company can leverage variable cost analysis to calculate exactly how many items it needs to see to break-even as well as how many units it needs to sell to make a specific amount of money. A company's break-even point is calculated as fixed costs divided contribution margin, and contribution margin is calculated as revenue - variable costs. Variable costs determine the break-even point.Any strategic plans relating to growth, contraction, or expansion to new products will likely incur changes to variable costs. To do so, it must be aware that variable costs will also proportionally increase. For example, for a food truck, fuel is probably a fixed cost (it takes the same amount of fuel to move the food truck regardless of how much food the business. A company may plan to double its output next year in an attempt to scale revenue. Variable costs are an integral part of budgeting and planning.By performing variable cost analysis, a company will better grasp the inputs for its products and what it needs to collect in revenue per unit to make sure its earning money.

A company usually strives to competitively price its goods to recover the cost to manufacture the goods. Variable costs help determine pricing.

0 kommentar(er)

0 kommentar(er)